Join us...

... and be part of the international GARANT Family

GARANT is the most international company that brings together international buying group know-how and market knowledge. The ambitious goal: providing services to its clients and develop successful business concepts all over the world.

More than 2500 owner-managed small and medium-sized businesses in Europe and worldwide rely on the successful trade and collection brands, business concepts, attractive purchasing conditions and service offers.

Do what they do and take advantage of our power.

As the specialist for specialists, GARANT Group promotes the business profile of specialism, that of their trade partners in their regional surroundings. This is achieved by providing intelligent, targeted marketing concepts and farsighted product mix policies in all business sectors.

Trade partners profit from the know-how in the furniture, bedding, kitchen and the HVAC and Sanitary segments from tailor-made services, for example in marketing, finance, and trainings

PARTNER IN MANY MARKETS

– home all over the world

Originating from the heart of Germany and especially of the highly regarded German furniture industry, GARANT expanded early to achieve an international reach. While the German market is still the biggest within the Group, GARANT started its activities in DACH. 10 years later, GARANT’s buying group activities cover most of Europe.

To scale the international business, the prevailing experiences and networks, especially in Asian markets, were put into business concepts – the result is the development of an International Franchise concept that offers partners “All the best from Germany”. Having a flexible and scalable business model at hand, GARANT is active on almost all continents. Currently, the activities concentrate, next to Europe, on Asia and Latin-American. Nervertheless, the Middle-East, Africa and North-America are in intensive sight …

It is our mission to bring to all of our international and national clients the in-depth knowledge and industry competence that made GARANT great in Germany.

International buying group

International Franchise

Buying group – our corebusiness, your advantage

GARANT as a buying group concentrates on the trading partner and the relevant furniture industry. The goal is to mitigate between trade and industry to achieve the best conditions for a successful business. Furthermore, the offering of own trade and collection brands drive the competitive position of our partners. In addition to this, GARANT supports their partners with valuable and needed services to guarantee the individual success.

The target group are independent entrepreneurs and trading partners in the furniture trade market. GARANT’s core competence to offer here is concentration of purchasing power in order to attain attractive conditions and reimbursements for the trading partners. The supplier portfolio is quite broad and “flat” – the business principle is based on voluntary.

Revenues are generated together with the industry and the suppliers.

The increasing demand in furniture “Made in Germany” from old and new export markets (EU and Asia) let domestic suppliers of Germany face both great chances and challenges. The rising numbers of bankruptcy in trade and retail following market saturation and crowding out, ask for innovative marketing concepts to compete in the future.

Despite the recession accompanied by forecasts of negative GDP of 0.75% for the current year (2012), experts anticipate growth at 1.12% for 2013, generating stronger demand in the home furnichings sector.

Despite the rise in GDP from -0,1% to +0.7% between 2010 and 2011 and falling inflation over the same period, the furniture industry is still suffering from the collapse of the construction industry – once the country’s largest industry sector – and is likely to continue to do so in the future.

Given the high average per-capita income of the population (65.000 CHF), continuous growth in GDP by an annual average of about 2% and highly discerning consumer behavior, players in the high-end sector must develop sophisticated operating concepts.

With industry sales growth exceeding 2% for seven consecutive years and a close-knit network of large-scale retailers, the home accessories sector offers the greatest growth potential for our partners.

International Franchise – German design goes international with KONZEPT HAUS

GARANT HOLDING INTERNATIONAL S.A. has comprehensively developed its franchise concept for the international market. With "Konzept Haus", a comprehensive retail format for high-quality furniture and individual services for modern, urban living spaces was created.

Based on the well-founded international experience, GARANT Global Franchise and Partnership S.A.R.L., based in Luxembourg, is now developing and distributing a significantly expanded global franchise concept. This franchise system is based on a comprehensive, strategically developed and highly commercially oriented retail format. "Konzept Haus" offers high-quality premium furniture from Germany combined with excellent service in an inspiring, casual-cool environment. The focus of the target group approach are especially modern, well-informed and well-educated women from the urban environment. The collection consists of high-quality furniture that reflects modern German design and lifestyle. In terms of functionality and style, the furniture is geared towards urban living environments. They are perfectly coordinated, modern and compact in size and shape.

A central component of the brand and concept is the interior design service. The store serves as a showroom, while the actual dialog and consultation process takes place at the customer's home. Based on this, the "Konzept Haus" stylists create professional and visualized furnishing concepts for the customer. The result is a sustainable and highly individual customer relationship and a quality of advice that cannot be replicated digitally. Brand and collection find their home in the "Konzept Haus" store, an innovative and strongly differentiating store design concept.

The "Konzept Haus" is an inner-city furniture boutique with a size of 500 square meters, in the lively neighborhood of fashion stores and restaurants, preferably in 1A and 1B locations. Highly developed and sophisticated are not only the concept elements at the interface to the customer, but also the "backend", i.e. the IT-supported functions and processes in logistics and administration. After an intensive pilot phase with a few selected partners, the cross-country rollout of the system is planned from 2022.

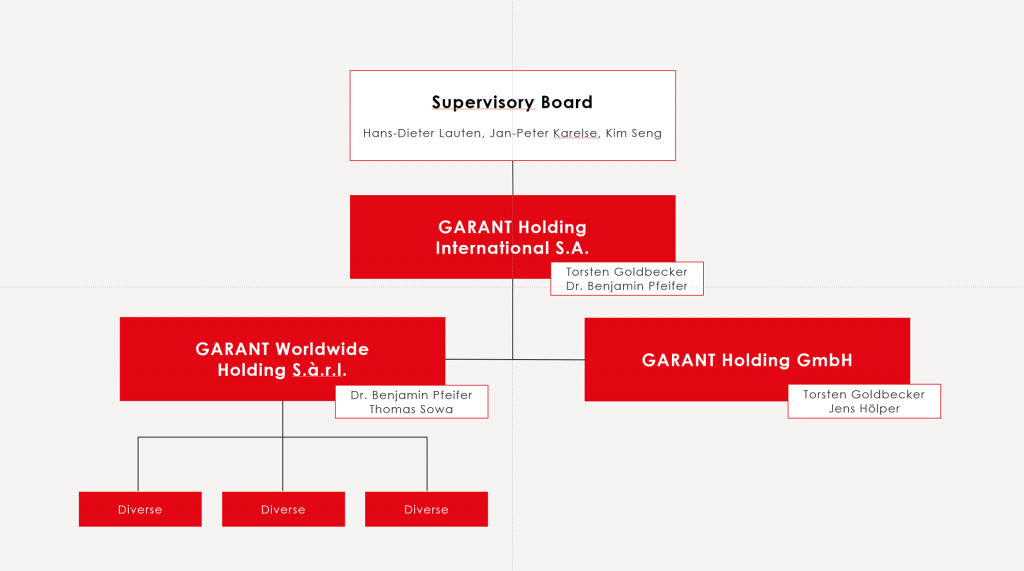

ORGANISATIONAL STRUCTURE

The International Group is organized through a flat and efficient structure. Residing in Luxemburg provides the means to scale internationally while remaining a true European player.

TEAM

Torsten Goldbecker

CEO

Thomas A. Sowa

Head of Corporate Finance and Business Development

Jeffry van de Vijver

Head of International Sales

TEAM

Elfriede Röder

Assistent to the Management

Corinna Schumacher

Office Management

HISTORY

Since its first move to international markets in 1987, the GARANT Group has successfully established itself in 6 international markets throughout Europe and Asia. With a total of over 2500 retail members internationally, the GARANT Group is among the largest and fastest growing international furnishing groups. A key growth driver for the future is the development and penetration of new markets in Europe and Asia. With expertise gained and developed by the GARANT Group throughout more than 50 years of company history, long-standing relationships with industry partners and a broadly based network of highly specialized service providers from all areas of the industry, the GARANT Group offers the best structural and personnel-related preconditions for the successful establishment of new retail and trade structures on European and Asian markets.